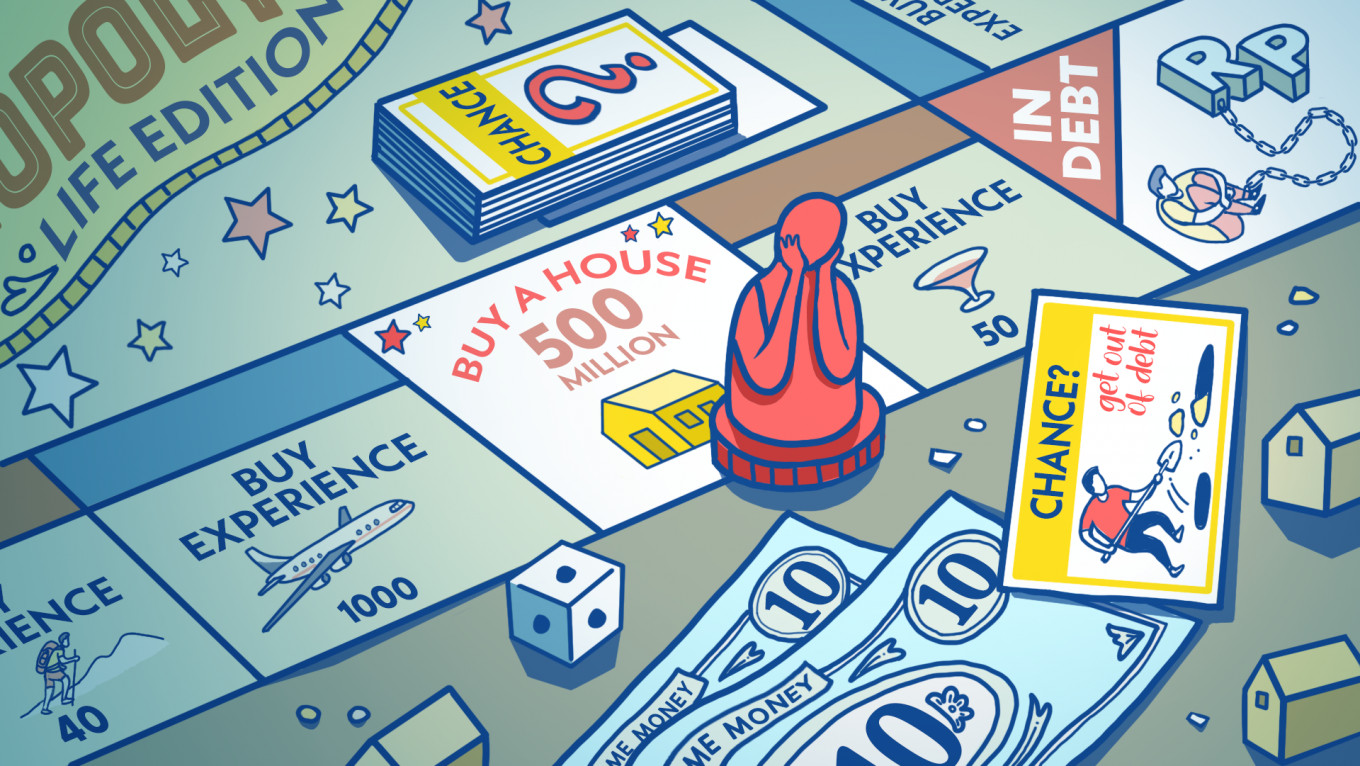

I can’t recall a moment in my adult life when buying a house felt like a real goal.

To me, the idea that owning a home equals security feels... outdated. The past few years have shown just how quickly things can shift. That sense of stability or permanence? It might be an illusion, or worse, a liability.

Apparently, I’m not alone. Studies suggest nearly two out of three Gen Zs would rather rent than buy, even if that comes with higher commuting costs or low-key housing anxiety. And yet, I still hesitate to call that a smart financial move.

Let's be honest: owning a house is still a dream. It’s just one we’ve started to question more deeply.

Terms of commitment

Buying a home isn’t just a purchase. It’s a commitment that reshapes your lifestyle, your options and even your future self.

Thank you!

For signing up to our newsletter.

Please check your email for your newsletter subscription.

You don’t always see the financial stress coming. It creeps in slowly, often after the down payment has cleared. Mortgage installments start dictating life decisions: how often you work from the office, where your kids go to school and whether you can afford a last-minute trip with friends.

The house becomes your center of gravity. But if your finances wobble, it can throw everything off balance. And what should have been an anchor can become a burden for years to come.

(Shutterstock)

That was what happened after Ningsih, 38, bought her house in Tangerang at age 35 with a 20-year loan. That means she’ll be 55 when she finishes paying it off.

“I’ve wanted my own space since I was in middle school,” she shares.

Growing up in a packed, multigenerational home made privacy feel like a luxury.

“And I want something I can pass down to my children, something that I didn’t have growing up,” she adds.

With the long loan tenor, however, a Rp 400 million (US$24,000) house will end up costing more than double that after interest.

“But that’s what I can afford right now,” she says.

“I committed 30 percent of my income to this. It’s doable, though I do get jealous when I see my colleagues traveling.”

Family expectations, financial realities

Not everyone buys a home for themselves. Sometimes, it’s for family, whether they asked or not.

Laura, 35, had no plans to own property until her mother urged her to buy a house so they could finally settle down. She caved, taking out a 20-year loan on a two-story townhouse in South Jakarta. Her sibling agreed to help with the installments.

But halfway through the loan, her sibling backed out.

“I wanted to sell the house,” Laura admits. “It wasn’t even my idea to begin with.”

Instead, she found herself resenting both the house and the expectation behind it.

What was meant to be a gift became a source of financial strain, and emotional tension.

A home, once seen as a symbol of independence, can now easily turn into a trap. Sure, you can consider all factors, financial, mental, emotional, before committing to a house. But the uncertainty that lurks in the shadows can be daunting.

The option for the few

But what if the commitment wasn’t that long? With shorter loan tenures, you’re more likely to avoid painful uncertainties and save on interest fees.

That’s why Donny, 32, went for a five-year fixed-rate loan when he bought a 3-story home in BSD.

“If you can manage a shorter tenure, do it,” he advises.

“You get more freedom, and you’re not stuck paying forever.”

His strategy is to eventually sell with capital gain. It sounds like a clever plan, but few can afford the payment terms required for that kind of loan.

(BNDL Studios/JP)

Ika, for example, tried to do it on her own.

“I’ve been saving since college,” she says, knowing early on that she probably wouldn’t inherit anything from her parents.

But her savings weren’t enough to afford an eight-year loan with a 50 percent down payment, equivalent to over Rp 1 billion, for a house in BSD, Tangerang, Banten.

So she ended up asking her parents for help, a privilege few also have.

“I don’t think you can buy a house in Jakarta from your income alone,” says Laura.

“If your parents want you to have one, they should help. That’s fair.”

Even then, Ika says, “it still feels like a liability”. The house also remains empty, because it’s too far a commute from her office in Jakarta.

(Shutterstock)

For most young people, the home ownership dream feels less like a choice and more like something slipping out of reach. Property prices rise faster than salaries, down payments feel impossible without family wealth and even those who manage to buy often feel trapped instead of secure. It’s no wonder that frustration runs deep, what used to be seen as a normal milestone is now, for many, a luxury.

What if the dream changes?

At some point, the question shifts from Can I afford a house? to Should I even want one right now?

“If I could choose again, I would choose to rent, even if I have a family,” says Laura.

“I know a lot of decent houses within my budget. And I can use the rest of my savings for investment in my own business or others.”

That sounds sensible, but it also assumes you’ll eventually have the chance to buy later. For many in my generation, though, that chance may never come.

And it’s not to say renting is the answer. It comes with its own anxieties, like being priced out of your neighborhood, or dealing with landlords who can raise the rent or sell the property.

That’s why people like Fito, 33, choose to continue living in his parents’ home while saving for a future home.

“To be honest, as long as my parents are okay with it, I’m staying,” says Fito.

“A lot of people my age still live with their parents, even after marriage.”

There’s no shame in that.

“I also don’t want to buy a house that my future partner won’t like. That’d be a waste of money,” he says.

“She also needs to have a say in our future home.”

(Shutterstock)

The idea of home as an investment asset, which often prompts people to buy early, is also losing its appeal.

“I think that might work only in a few districts,” says Fito.

“Too many unpredictable factors now.”

So where does that leave us? Somewhere between frustration and acceptance.

For many, ownership feels impossible. For others, it’s still a dream, just delayed.

For me, it’s neither a race nor a deadline. Maybe the real achievement isn’t a house at all, but the ability to build a life that feels steady, even if it doesn’t look like the blueprint we were promised.

Michelle Anindya is a writer and journalist. She is currently a post-graduate student of Anthropology at the University of Indonesia, focusing on how technology is used in religious communities.